To recap my big five predictions that all came true,

- Told my readers to get into gold in 2002;

- Told them to get out of the housing market in 2006;

- Predicted the recession of late 2007;

- Told my readers to get out of stocks in the fall of 2008; and

- Told my readers to get back into stocks in March of 2009.

- In fact, I’m a humble person who prefers a low-key profile. I have a Master’s Degree in Finance and Economic Strategy from one of the top business universities in USA. Most importantly, I’m a successfully predicting about commodity prices and I have a deep love of economic analysis and the stock market.

What I’m about to tell you, my prediction number six, which is about to happen, is so off the wall, so controversial, I didn’t want you to think it was coming from some kind of quack. It’s coming from someone with a proven track record at making economic and financial forecasts.

Let’s fast forward to March of 2012, where we are today.

The economy is slowing. Retail sales in the U.S. are running at their slowest pace in five months. After trillions of dollars the government has pumped into the economy to revive it, U.S. corporations ended the 2011 with their slowest profit growth in two years.

Last year was the worst year for new home sales in the U.S. since 1963! And a glut of foreclosed resale homes still overhangs the housing market. Housing prices are set to fall again in 2012.

What economist like me really like to look at, the underemployment rate (that’s the unemployment rate adjusted to include people who have given up looking for work and part-time workers who want full times work) stands stubbornly at 15% in the U.S.

Banking is still a mess. Europe’s debt crisis is a huge problem for American banks; their exposure is close to $3 trillion.

Many European countries are in a recession again and I believe the United States is on the cusp of falling back into a recession. Some will call it a new recession. I will call it “Recession Part II.” But this is not the real problem.

While my colleagues will dance around the issue, while other economists will not utter the words, I will put it in writing:

“The U.S. is technically bankrupt.”

USA budget deficit this year will be $1.3 trillion. Official national debt exceeds $15 trillion and this past summer Congress gave the Obama Administration permission to increase the debt to $16.4 trillion. Unofficial national debt, when you take into account unfunded liabilities and entitlement to our citizens, is closer to $127 trillion.

By the end of this decade, according to the White House’s own prediction, the official national debt will surpass $20.0 trillion—not including off-balance-sheet items like old-age security, Medicare, and other government promises to its citizens.

And there’s also hidden government guarantees not on the government books…

Fannie Mae and Freddie Mac own or guarantee half the residential mortgages in America. Who owns both of these companies now? Why, it’s the U.S. government. They “censured” both Fannie Mae and Freddie Mac on September 7, 2008.

In effect, the government either owns or guarantees half the outstanding residential mortgages in this country. According to data compiler CoreLogic Inc., some five million home mortgages in the U.S. were either in the foreclosure process or delinquent last month, exposing the government to even more losses.

Politician after politician has failed to reduce government spending. Their belief is that spending more money will fix the economic problem. Well, they’ve spent trillions since 2008 and the economic problems are about to get worse.

The U.S. government and the politicians that run it are addicted to spending more money than the government takes in. If we look at it conservatively, and only look at the government’s “official” figures, by the end of this decade, the national debt will be about 150% of our GDP—about the same level it was after World War II.

Why USA will never get out of this hole

After World War II, America became a superpower. The manufacturing base grew dramatically; the industrialized revolution was so great that the American dollar replaced gold as the reserve currency of other world central banks. There was a U.S. job boom.

Today, what do Americans have to carry into the next boom? Nothing. The Internet isn’t creating jobs. Manufacturing, it’s gone to Mexico, India and China. I doubt George Washington ever envisioned a future where Americans would be suffering so much. It’s embarrassing, but true: Over 44 million people in this country are using some form of food stamps! (Source: National Inflation Association)

America, the Empire, is history. The Standard & Poor's downgrading of the U.S.'s credit rating this past August 5th, 2011 is just the beginning.

“The U.S. lowered interest rates in 2004 to their lowest level in 46 years. And what did Americans do with their access to easy money? They borrowed and borrowed some more, investing the borrowed money into real estate. Looking ahead, perhaps the Fed’s actions (of 2004) will one day be regarded as one of the most costly errors committed by it or any other banking system in the last 75 years.”

I was exactly right.

Artificially low interest rates are actually causing Americans harm

Interest rates have remained so low for so long that inflation will become a serious problem for America in the months and years ahead. With the price of gold having risen 500% in less than a decade, gold is screaming, “inflation ahead!”

How does the government and an economy deal with inflation? Inflation is dealt with via higher interest rates. Mark my words: The artificially low interest rate policies of the past few years will come to hurt us in the form of hyper-inflation and sharply higher interest rates.

It will get worse

My prediction is not only that USA is headed into Recession Part II—my prediction is that this next recession will also be much worse than the 2007-2008 recession and that it will hit as deep as the Great Depression.

You see…

USA government has no money left to bail out during the next recession. The government is over-extended—if it was a business, it would be bankrupt right now.

The Federal Reserve has kept the economy alive the past three years by keeping its printing presses running overtime.

Let’s face two important facts.

The Fed can’t lower interest rates below the zero they are at today. The more money the Fed prints, the greater the risk of inflation, and the higher long-term interest rates will eventually move, stifling the economy.

Let’s move to the stock market

Did you know there is a striking similarity between the years 1934-1937 and 2008-2011?

Look at these facts:

The stock market crashes in 1929. Eighty years later, in 2008, it does the same thing.

The bear market rally that started in 1934 lasted until 1937—and took the Dow Jones Industrial Average from a level of 90 to 185, a gain of 106%. The Dow Jones then plummeted and didn’t recover until seven years later, 1944.

So similar it’s frightening: The bear market rally that started in March 2009 has lasted three years so far and has resulted in the Dow Jones Industrials rising about 100%.

If the current bear market rally follows the same path as the bear market rally of 1934 to 1937, It has only a few more months left before the next phase of this bear market gets underway, ultimately bringing stock prices below their March 2009 lows.

This time around, for reasons I’ve just explained, the after-effects of the next leg of the bear market could be much worse than the Great Depression.

At this point, I assume you are sitting there, watching and listening to this audio-video presentation and saying, “Okay, Shan Saeed, what you say is stark and frightening. But it makes sense, the way you’ve laid out the facts.”

“So what do I do as an investor and

consumer to protect myself?”

The good news is that you could protect yourself from the economic devastation headed the way over the next six months. The better news is that, if you position your portfolio properly, starting today, you could actually make money during the next devastating down leg of this economy, while others struggle like never before.

Here are my five core beliefs about what’s headed America's way and how I plan to actually profit from them.

1. The devaluation of the U.S. dollar that started in early

2009 will accelerate as the U.S. economy deteriorates.

After World War II, the government did a masterful job at convincing foreign central banks they should have U.S. dollars as their reserves instead of gold bullion. Today, 63% of world central banks have adopted the U.S. dollar as their official reserve currency.

As the value of the greenback erodes under a mountain of debt and coming rapid inflation, courtesy of too many dollars in the financial system (thank you, Federal Reserve), foreigners will be dumping dollars and moving away from a system where the greenback is the official reserve currency. China, Russia and Japan have already started lowering US dolalr treasuries from their reserves.

Chart courtesy of www.StockCharts.com

Look at it this way. Since President Obama took office four years, the U.S. national debt has increased by about $5 trillion dollars—50%. At the same time, the Federal Reserve has increased the size of its balance sheet by $2 trillion.

Where are all these trillions coming from? In the end, I believe the U.S. dollar will collapse under a mountain of unsustainable debt.

Shorting U.S. dollars is too risky and complicated for most of my readers. But there is a simple, easier way to make money as the U.S. dollar continues to devalue. There is an ETF you can buy that goes up when the U.S. dollar declines in value.

This ETF is in the currency that I believe will rise the most against the U.S. dollar over the next two years. No, it’s not gold. It’s a fiat currency that is up close to 10% against the U.S. dollar over the past five months alone. It’s a currency of one of the economically strongest countries in the world.

You put your money in this ETF, sit back, do nothing, and watch the value of the U.S. dollar fall as inflation and the national debt rise, and just watch this investment rise in value as the months go by.

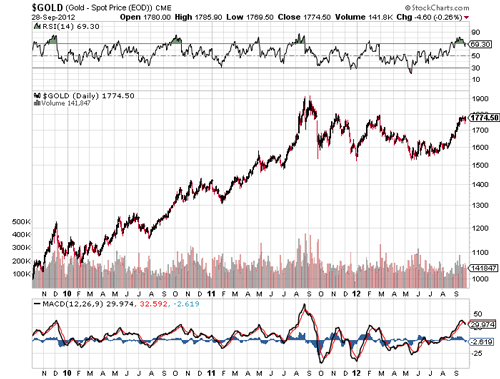

2. Gold prices will continue to rise.

When we look at the price of gold bullion today in inflation adjusted terms, it would need to be trading at $2,250 an ounce to be equal to its January 1980 price high of $850 an ounce.

But my public predictions about where gold prices are headed have been much higher. I’m expecting gold to trade at $3,000 before the bull market in the yellow metal is over.

Chart courtesy of www.StockCharts.com

Here’s an important fact I want you to be aware of:

After reaching an all-time record high of $1,921 an ounce on September 6, 2011, gold bullion prices have fallen back.

But we’ve been down this road many times before! In early 2003, the price of gold bullion fell 16%; in the summer of 2006 the price of gold fell 21%; from the spring to the fall of 2008 gold prices fell 28%; in the spring of 2009 gold prices fell 15%-- and each time the price of gold bullion recovered and moved higher by year’s end.

In fact, for 11 years running the price of gold bullion has closed each year higher in price than it started the year. The recent weakness in gold bullion prices (more like a correction in an ongoing bull market) is a tremendous opportunity for smart investors.

I’m a big bull on gold. Rising inflation, a debasing U.S. dollar, out-of-control government spending, and a currency printing press that never seems to stop will continue to push the price of gold higher.

But when I look at gold, if it moves from $1,700 or $1,800 to $3,000 an ounce over the next five years, as I expect it to, my gain will be close to 100%—as an investment, that’s not enough for me. I’m gunning for much bigger profits than that.

The big winners of the gold bull market will ultimately be the gold mining stocks. Look at this way. If a gold company’s cost to produce one ounce of gold is $900, at a price of $1,800, they are making a 100% profit. But, at price of $3,000, they are making a profit of 233%—and the stock market will reward the stock by multiples of 233%.

3. The euro is as done as the U.S. dollar.

I’m blessed to be able to visit Europe once or twice a year to check on the economies of various European countries. Let me tell you firsthand, things are much, much worse in Europe than people read in the mainstream media.

On October 27, 2011, the euro zone leaders said they would bail out Greece, with European banks taking a 50% haircut off the value of their loans to Greece. By February 20, 2012, the eurozone Finance ministers agreed to a second bailout for Greece.

Greece has technically defaulted on its debt. I believe Spain and Italy are not far behind.

Austerity measures are a difficult sell in Europe. On the same day Greece passed its most severe austerity measures yet, February 12, 2012, 100,000 Greek citizens took to the street in protest. A 5,000-man police army was not enough to stop the protestors from setting fires to buildings. In a nut shell, Athens burned as the latest Greek austerity bill was passed.

2012 will bring stronger citizen protests in Europe thanks to even more severe austerity measures that will be introduced this year.

Every morning, I wake up and ask this one question: when will Germany come to its senses and pull out of the euro? After all, Germany is the only real engine of the European Economic Community. Greece’s GDP…it’s less than 10% of Germany’s GDP.

The euro has declined steadily against the U.S. dollar. I actually envision a time when the richer European countries will tire of bailing out the poorer European countries (it’s actually happening right now), when each country will just go back to its own currency. Ultimately, the euro will die, and with it the economies of the weaker European countries: Greece, Spain and Italy.

4. Inflation will become a real problem in America.

According to the U.S. Bureau of Labor Statistics, the producer price index (“PPI”) is running at 4.1% per year.

While few are talking about it, inflation is a real problem in America. That’s what the rise in gold price has all been about: Gold is screaming: “Higher inflation ahead!”

Thanks to years of monetary policies that promoted artificially low interest rates and printing presses churning out dollars in overtime mode, hyperinflation and American sovereign debt issues will become the biggest obstacles for the United States for the remainder of this decade and well into the next decade.

After falling for 30-years, short-term interest rates are bottoming out. The long-term 10-year U.S. Treasury, it’s yielding a pathetic 2%-- a 50-year low. All cycles come to end. And I believe USA is near the end of a long-term down cycle in interest rates.

While it may difficult to see today, and as crazy as it may sound, the government will be forced to raise interest rates to fend off inflation—just like it did in the early 1980s..

Higher interest rates will also put the proverbial remaining nails in the coffin known as the U.S. housing market.

Now you see why I said at the very beginning of this article that it’s not for the faint of heart. Imagine our government, the economy, housing prices and the stock market all collapsing at the same time? But, for smart investors, there is more than just hope. As history has shown us, where there is fear, there is also profit.

5. The stock market will ultimately test its lows of March 2009,

bringing the Dow Jones down 46% from where it sits today.

Yes, this is my final core belief: The bear market rally in stocks will lose steam somewhere in the next few months and move straight down to test its March 2009 lows.

Phase One of a bear market brings stock prices down sharply. That’s what happened when the Dow Jones Industrial Average fell from 14,164 in October 2007 to 6,440 on March 9, 2009—a tumble of 54%.

Phase Two of a bear market is when the bear lures investors back into stocks. The bear gives investors and analysts the false sense that the economy is improving and it’s okay to own stocks again. The bear did a masterful job at convincing investors to own stocks again…and, presto, the Dow Jones got back to over 12,000. But the bear market is getting old and “long in the tooth” as they say. If I compare this bear market rally to the bear market rally of 1934 to 1937, we have a few months left before Phase Three of this bear market gets underway—ultimately bringing stock prices below their March 2009 lows.

Disclaimer: This is just a research piece and not an investment advice. All financial transactions carry a RISK.

No comments:

Post a Comment